Unlocking Potential: The Rise of Virtual Bookkeeping Companies

In today’s ever-evolving business landscape, effective financial management is crucial for success. Small and medium-sized enterprises (SMEs) often face challenges in managing their books, a task that requires precision, knowledge, and a significant time investment. This is where virtual bookkeeping companies come into play. These innovative service providers offer a blend of technology and professional expertise, enabling businesses to focus on what they do best: growing and thriving.

The Transition to Virtual Bookkeeping

As businesses strive for efficiency and cost-effectiveness, many are transitioning from traditional in-house accounting practices to virtual bookkeeping services. The reasons for this shift are numerous:

- Cost Savings: Engaging a full-time bookkeeper can strain small business budgets. Virtual bookkeeping companies offer a fraction of the cost while providing high-level expertise.

- Flexibility: Compared to traditional firms, virtual bookkeeping services are typically more flexible in terms of service hours and project scope. They can be tailored to meet specific business needs.

- Access to Advanced Technology: Virtual bookkeepers often employ cutting-edge software that automates and streamlines processes, ensuring accuracy and efficiency.

What Services Do Virtual Bookkeeping Companies Offer?

Virtual bookkeeping companies provide a vast array of financial services aimed at simplifying the complexities of business accounting. Here are some key services:

1. Comprehensive Bookkeeping

This includes tracking income and expenses, reconciling bank statements, and maintaining an organized ledger. Virtual bookkeeping companies ensure that all financial transactions are recorded accurately and timely.

2. Payroll Processing

Managing payroll is a vital aspect of any business. Virtual bookkeepers handle payroll processing, tax withholdings, and ensure compliance with employment laws, allowing business owners to focus on other priorities.

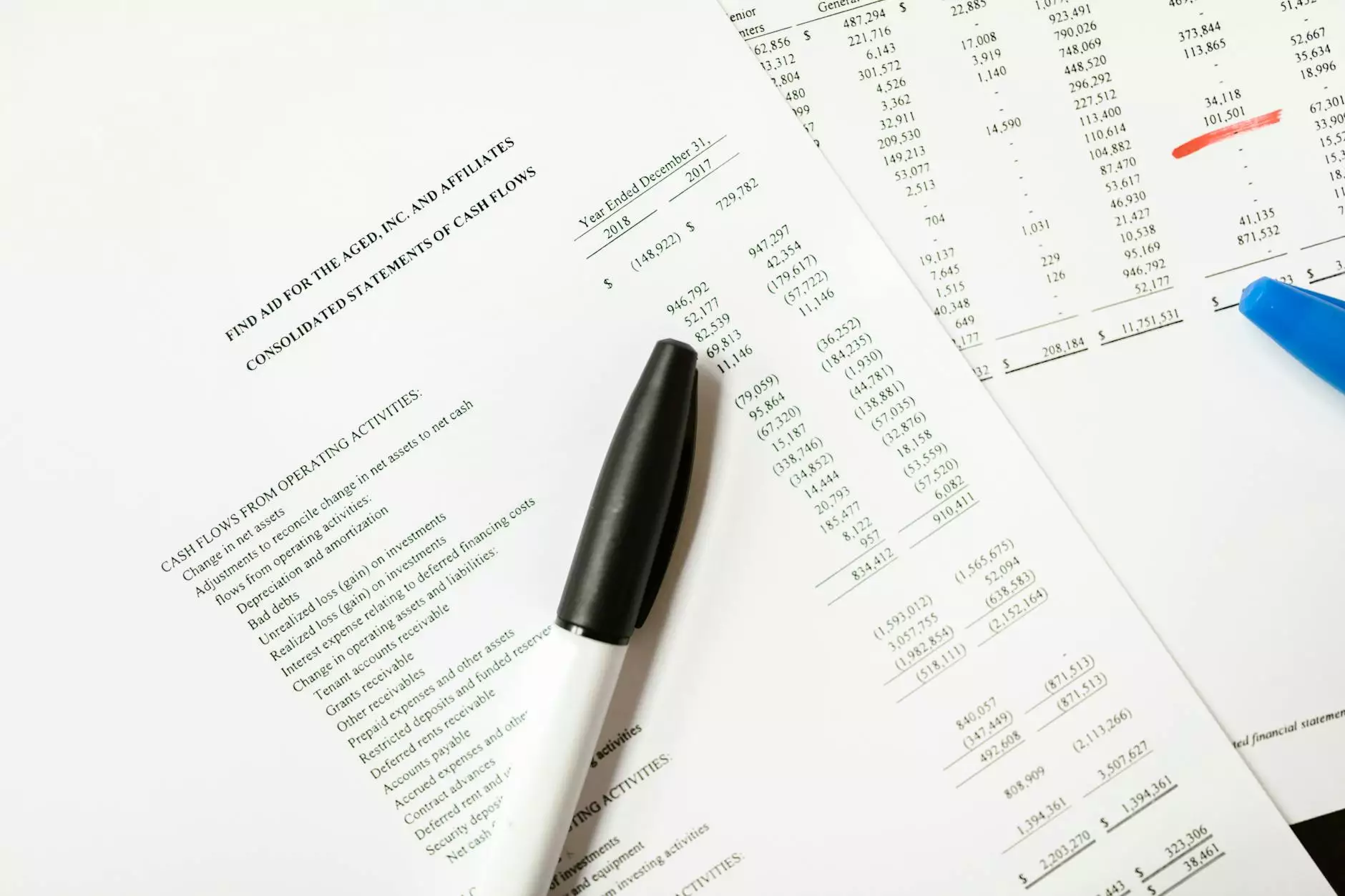

3. Financial Reporting

These companies provide detailed financial reports that give business owners valuable insights into their operations. Key reports include balance sheets, profit and loss statements, and cash flow statements.

4. Tax Preparation and Planning

One of the most daunting tasks for business owners is tax preparation. Virtual bookkeeping firms help with tax compliance, ensuring that all deductions are utilized, and assist in strategic tax planning.

5. Budgeting and Forecasting

Effective budgeting and forecasting are essential for growth. Virtual bookkeeping professionals help businesses create realistic budgets and forecast their financial future based on historical data.

The Benefits of Using Virtual Bookkeeping Services

The benefits of utilizing virtual bookkeeping companies extend beyond mere convenience. Here’s an in-depth look at why businesses are making the switch:

Enhanced Accuracy

With professionals who specialize in bookkeeping, businesses can expect a higher level of accuracy in financial records. Mistakes can be costly, and having experts manage your accounts minimizes this risk significantly.

Time Efficiency

Time is one of the most valuable resources for any business owner. By outsourcing bookkeeping, entrepreneurs can redirect their focus on core business activities and strategic growth.

Scalability

As businesses grow, so do their bookkeeping needs. Virtual bookkeeping companies can easily scale their services to accommodate a company's growth, adapting to increased complexity without the hassle of hiring additional staff.

Expertise and Guidance

Business owners benefit from the advice of financial experts who understand the nuances of accounting and adhere to the latest compliance regulations. This guidance can lead to better financial decisions.

Choosing the Right Virtual Bookkeeping Company

With a growing number of virtual bookkeeping companies, selecting the right one can be overwhelming. Here are essential factors to consider:

Experience and Qualifications

Look for companies with a proven track record and qualified professionals. Certifications such as CPA (Certified Public Accountant) or a degree in accounting are indicators of reliability.

Services Offered

Different businesses require different services. Make sure the virtual bookkeeping company you choose offers the specific services you need, whether it’s complete bookkeeping, payroll, or tax help.

Technology Utilization

Inquire about the technology and software the company uses. Efficient bookkeeping relies on robust software that can integrate with your systems.

Transparent Pricing Structure

Pricing models can vary significantly between providers. Opt for a company with clear, transparent pricing and no hidden fees to ensure you stay within budget.

Client Support

Reliable customer service is paramount. Choose a company known for its responsive support, ready to assist you whenever needed.

Case Studies: Success with Virtual Bookkeeping Companies

To illustrate the transformative power of virtual bookkeeping, here are a couple of case studies showcasing businesses that benefited immensely:

Case Study 1: A Growing E-commerce Brand

A small e-commerce business struggled with financial record-keeping as it expanded. By partnering with a virtual bookkeeping company, they gained access to a team that streamlined their bookkeeping process, implemented automated invoicing, and provided monthly financial reports. As a result, the owner saved 10 hours a week and directed that time towards marketing and customer engagement, ultimately doubling their revenue in just one year.

Case Study 2: A Local Restaurant Chain

A local restaurant chain was overwhelmed with managing payroll for multiple locations. They turned to a virtual bookkeeping service that provided efficient payroll management and tax compliance assistance. The company was able to reduce payroll processing time by 50%, significantly decreasing the stress on management and improving employee satisfaction through timely payments.

The Future of Bookkeeping

The emergence of virtual bookkeeping companies marks a significant shift in how businesses manage their financial operations. With advancements in technology and a growing reliance on remote services, the future of bookkeeping is bright. Companies will continue to innovate, providing more efficient, comprehensive, and scalable solutions to meet the demands of modern businesses.

Conclusion

In conclusion, the rise of virtual bookkeeping companies represents a paradigm shift in financial management. By leveraging their expertise, technology, and adaptive services, businesses can unlock tremendous potential and streamline their operations. Whether you are a startup or an established firm, partnering with a virtual bookkeeping provider like those at booksla.com can pave the way for financial clarity and growth, allowing you to focus on your passion – running your business.

Discover More

To learn more about how our services can transform your business’s financial health, visit booksla.com today.